Prior to this, Ryan is probably most famous for his budget plan, known as "The Path to Prosperity", which the Republicans in the House of Representatives passed earlier this year. I posted about this last year, but I thought I'd take a closer look at the proposal after reading that Mitt Romney would pay 0.82% in taxes under the Ryan plan. (!) This is because the plan eliminates taxes on capital gains, dividends, and interest.

The full plan (warning: big .pdf) includes a bunch of non-tax stuff (including the plan to turn Medicare from defined-benefit to a defined-contribution), but I just read through the tax parts because I'm not a total masochist :-) For those of you following along at home, these are on pages 59-67.

It starts by saying the tax code is complicated (true!), and unfair because of the special credits, deductions, and loopholes that apparently cost $1 trillion a year(!), which is roughly how much the government actually collects in individual income taxes. That is...well, surprising.

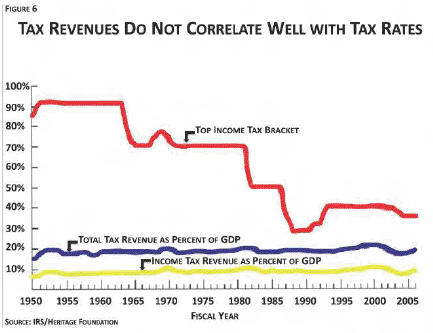

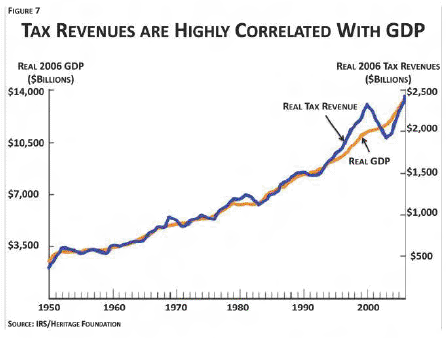

It then shows a pair of graphs claiming to show that tax revenue really just depends on GDP and not the tax rates. Here they are:

I think the first one is a little misleading - you can't just look at the top tax rate and use that to determine how high the "overall" tax rate is - the other brackets and rates matter too. (although, to be fair, that's a lot of variables and it's hard to combine them all) For example, in 1950 the top tax rate was 90%, but that bracket didn't start until an income of $400K, which in today's dollars is roughly $3.6 million. (by comparison, the top tax rate today is 35%, but it kicks in at an income of ~$400K) I'm honestly not sure about these graphs - one interpretation is that as tax rates go up, people take more steps to avoid paying taxes. (using offshore accounts, etc.) Another interpretation is that the "average" tax rate hasn't really changed that much over the years.

The proposal talks about the corporate tax rate for a while, which it points it is the highest in the industrialized world (or will be soon, anyway), but lots of companies get around paying the full rate anyway. It says it would be better to lower the rate and eliminate loopholes, which I agree with (and Obama has proposed as well). One thing I did have clarified is that nearly 75% of small businesses file taxes as individuals, which is why Republicans often say that raising individual income taxes "hurts small businesses". (why do they do this? Seriously question...is it just easier than actually incorporating? I have no idea...)

Anyway, the gist of the whole thing is to reduce our current six bracket system (10%, 15%, 25%, 28%, 33%, and 35% - see current brackets here) to a two bracket system with 10% and 25% rates. One might immediately notice that this is a pretty huge tax cut for people making more than $400K/year. I also think that doing this in the name of "simplification" is a bit of a dodge - is the fact that we have six brackets instead of two really what makes the tax code complicated? No, it's all the deductions, credits, etc.

I'm not even going into the idea of not taxing capital gains, dividends, and interest (which I didn't even find in the plan, confusingly enough). One argument for not taxing these things is that it's "double taxation", since for example corporate profits are taxed, and then the dividends they pay out of their remaining money is taxed again. The phrasing always seemed weird to me, as if each dollar is only ever taxed once, which is of course totally untrue! When I get money in my bank account from my paycheck, that's money that has already been taxed, and then when I go out and buy a new phone, I pay sales tax on that too.

Finally, the whole premise of the tax part of the plan is that we can afford to lower the tax brackets by reducing deductions and loopholes and such. The problem is that a lot of these deductions (like, say, the home mortgage interest deduction) are really popular, so the plan cleverly takes the tack of not saying what would be removed. This makes it somewhat less of a plan and more of an idea. I'm wondering whether there actually was a real plan somewhere (after all, the House of Representatives passed something!), but I sure couldn't find it.

The plan also refuses to fund Obamacare, because why not? At this point it's really looking more like a wish-fulfillment scenario than a serious plan.

So...yeah. The whole idea of balancing the budget by cutting taxes (even the plan admits that revenues will be lower in 2014 and beyond) and then cutting spending even more (but, of course, not cutting defense spending), is really not that serious.