Tag taxes (8)

Mitt Romney and the 47%

Posted on 2012-09-24 21:13:00

Tags: rant essay taxes politics

Words: 611

(yes, I realize I'm late on this, but dang it I was out of town when this happened and I'm not going to miss it!)

So! Mitt Romney said some things about people who don't pay income taxes last week. From the article:

Fielding a question from a donor about how he could triumph in November, Romney replied:

There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that's an entitlement. And the government should give it to them. And they will vote for this president no matter what…These are people who pay no income tax.

Romney went on: "[M]y job is is not to worry about those people. I'll never convince them they should take personal responsibility and care for their lives."

A few things about this!

- It is true that 47% of people paid zero federal income tax last year. It is not true that these people paid zero taxes total. If you earn a wage, you pay payroll taxes. Everyone pays sales taxes. If you own a house, you pay property taxes. (and if you rent, part of your rent goes towards them) Most states have a state income tax. If you have a car, you pay registration fees, etc., etc., etc. Undoubtedly there are some number of people who don't pay any taxes (assuming they qualify for the Earned Income Tax Credit or some other refundable credit), but certainly not 47%.

- Fun fact - members of the military earn a lot of their income as tax-free!

- The statement that these people "will vote for the president no matter what", is clearly untrue. Taking a random national poll with crosstabs I could find, 43% of those that make less than $30K a year (which I think is a reasonable proxy) said they would vote for Romney. 43% is a lot bigger than 0%.

- More generally, people don't not pay any federal income taxes because they don't want to - they don't because they don't make a lot of money. I'm an agog at the logic here. Is he saying that people just don't want to get jobs? With unemployment still above 8%, and four job applicants for every open position, this is just hogwash. And somehow Mitt Romney knows that not only do they not want jobs, but they believe they're entitled to all sorts of things like, um, food.

- I don't even understand what he would change about this. Make sure everyone pays some taxes by eliminating things like the standard deduction and the EITC, one of the largest anti-poverty programs the US has? The only thing that makes sense is that he thinks people are choosing not to work because they're lazy and get food stamps. I just don't believe that's true in any sort of significant numbers.

- This is what class warfare sounds like, not things like "hey, maybe we should raise taxes on income over $250K or $1M" or something like that. No one (well, OK, not me) is saying that rich people are bad people - we just want them to pay their fair share. Taxes are not punishment.

- And, to be a little less fair, Mitt Romney is about the last person I want to talk to me about poor people. What does he know about their struggles?

(hey, Bill Clinton agrees with me!)

OK! I feel a little better now.

0 comments

link dump: tax deductions, paid apps are not like cups of coffee, video streaming copyright laws

Mood: chipper

Posted on 2012-08-30 14:17:00

Tags: taxes links

Words: 332

- When I talked about Paul Ryan's tax plan, one of my complaints was that the plan talks about closing tax loopholes, but didn't specify which ones. Here's a handy list of the deductions and how much they cost, and you see how hard this would actually be. Two of the three most expensive ones are pretty popular (mortgage interest and 401(k)), and of course one of the the fourth most expensive one is "lower rate on dividends and capital gains", which the Ryan plan would actually make a bigger deduction by taking the rate down to 0%!

- Speaking of Paul Ryan, there were a lot of lies in his convention speech last night.

- Stop Using The Cup of Coffee vs. $0.99 App Analogy - a good article on paid apps. Apparently a lot of people are making money with apps by making them free with ads (and in-app purchases). Maybe I should aim for this model more, but I'm apparently atypical because I like paying for apps and am not a huge fan of ads in apps. But getting people to pay is a big hurdle, and "free" is very enticing...

- Why Johnny can't stream: How video copyright went insane - a good Ars Technica article about how ridiculous streaming/time-shifting laws are.

- New Zealand is taking a step towards legalizing same-sex marriage, and they say the catalyst was Obama's endorsement of the same!

- This is old news, but SpaceX got a NASA contract to work on the next Space Shuttle and take people back into space. Congratulations to them, and I heart SpaceX so bad it hurts!

- Gotye made a "Somebody That I Used to Know" mashup of YouTube performances of the song, which is pretty cool. (and features Pentatonix's a capella version)

- Did you know you can totally buy a 3D printer for under $2,000? I did not.

- Another awesome Old Spice ad - this one's interactive!

- Astros Not Even Good Enough To Play For Pride - from the Onion, but still, the truth hurts.

1 comment

long post on Paul Ryan's tax plan

Mood: thoughtful

Posted on 2012-08-13 23:23:00

Tags: essay taxes politics

Words: 862

This weekend Mitt Romney picked Paul Ryan as his running mate. I think this is a good choice that really clarifies the election, as Ryan is a pretty staunch conservative. (according to DW-Nominate he's the most conservative VP pick ever)

Prior to this, Ryan is probably most famous for his budget plan, known as "The Path to Prosperity", which the Republicans in the House of Representatives passed earlier this year. I posted about this last year, but I thought I'd take a closer look at the proposal after reading that Mitt Romney would pay 0.82% in taxes under the Ryan plan. (!) This is because the plan eliminates taxes on capital gains, dividends, and interest.

The full plan (warning: big .pdf) includes a bunch of non-tax stuff (including the plan to turn Medicare from defined-benefit to a defined-contribution), but I just read through the tax parts because I'm not a total masochist :-) For those of you following along at home, these are on pages 59-67.

It starts by saying the tax code is complicated (true!), and unfair because of the special credits, deductions, and loopholes that apparently cost $1 trillion a year(!), which is roughly how much the government actually collects in individual income taxes. That is...well, surprising.

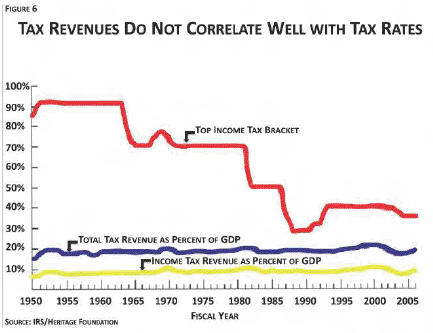

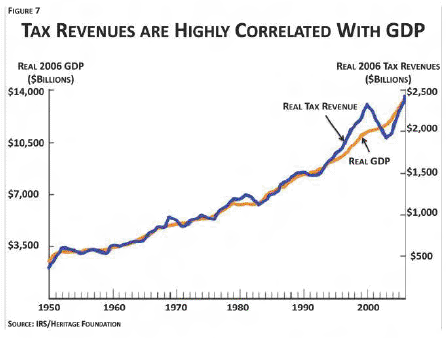

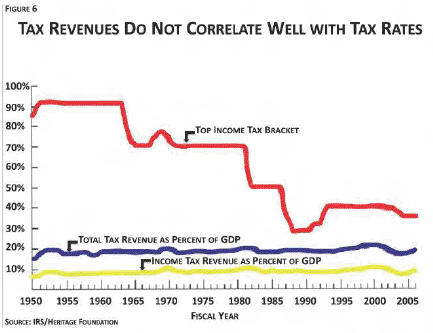

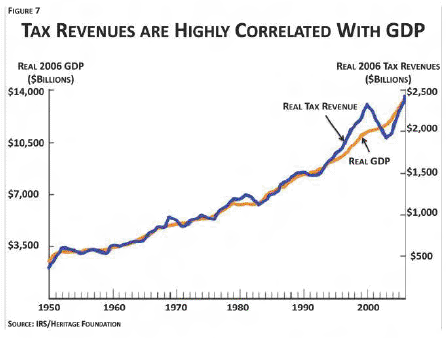

It then shows a pair of graphs claiming to show that tax revenue really just depends on GDP and not the tax rates. Here they are:

I think the first one is a little misleading - you can't just look at the top tax rate and use that to determine how high the "overall" tax rate is - the other brackets and rates matter too. (although, to be fair, that's a lot of variables and it's hard to combine them all) For example, in 1950 the top tax rate was 90%, but that bracket didn't start until an income of $400K, which in today's dollars is roughly $3.6 million. (by comparison, the top tax rate today is 35%, but it kicks in at an income of ~$400K) I'm honestly not sure about these graphs - one interpretation is that as tax rates go up, people take more steps to avoid paying taxes. (using offshore accounts, etc.) Another interpretation is that the "average" tax rate hasn't really changed that much over the years.

The proposal talks about the corporate tax rate for a while, which it points it is the highest in the industrialized world (or will be soon, anyway), but lots of companies get around paying the full rate anyway. It says it would be better to lower the rate and eliminate loopholes, which I agree with (and Obama has proposed as well). One thing I did have clarified is that nearly 75% of small businesses file taxes as individuals, which is why Republicans often say that raising individual income taxes "hurts small businesses". (why do they do this? Seriously question...is it just easier than actually incorporating? I have no idea...)

Anyway, the gist of the whole thing is to reduce our current six bracket system (10%, 15%, 25%, 28%, 33%, and 35% - see current brackets here) to a two bracket system with 10% and 25% rates. One might immediately notice that this is a pretty huge tax cut for people making more than $400K/year. I also think that doing this in the name of "simplification" is a bit of a dodge - is the fact that we have six brackets instead of two really what makes the tax code complicated? No, it's all the deductions, credits, etc.

I'm not even going into the idea of not taxing capital gains, dividends, and interest (which I didn't even find in the plan, confusingly enough). One argument for not taxing these things is that it's "double taxation", since for example corporate profits are taxed, and then the dividends they pay out of their remaining money is taxed again. The phrasing always seemed weird to me, as if each dollar is only ever taxed once, which is of course totally untrue! When I get money in my bank account from my paycheck, that's money that has already been taxed, and then when I go out and buy a new phone, I pay sales tax on that too.

Finally, the whole premise of the tax part of the plan is that we can afford to lower the tax brackets by reducing deductions and loopholes and such. The problem is that a lot of these deductions (like, say, the home mortgage interest deduction) are really popular, so the plan cleverly takes the tack of not saying what would be removed. This makes it somewhat less of a plan and more of an idea. I'm wondering whether there actually was a real plan somewhere (after all, the House of Representatives passed something!), but I sure couldn't find it.

The plan also refuses to fund Obamacare, because why not? At this point it's really looking more like a wish-fulfillment scenario than a serious plan.

So...yeah. The whole idea of balancing the budget by cutting taxes (even the plan admits that revenues will be lower in 2014 and beyond) and then cutting spending even more (but, of course, not cutting defense spending), is really not that serious.

1 comment

Taxes done! (and best IRS instruction ever)

Mood: relieved

Posted on 2012-02-18 14:08:00

Tags: taxes

Words: 144

We just finished our taxes! This year's vital stats:

Hours taken: around 5 (basically 8-midnight last night, plus an hour for copying/getting ready to mail)

Number of pieces of paper in my return: 13 (including Schedules A, C, D, and SE)

Best line seen in the IRS instructions: As I was looking for the rules on charitable deductions, I discovered this gem:

Certain whaling captains may be able to deduct expenses paid in 2011 for Native Alaskan subsistence bowhead whale hunting activities.

which is doubly awesome because I was just reading along about general charity stuff and them Bam! Whaling captains. (

It was tiring (especially due to NATI's stock split, which threw us for a loop for a short while), but I still do enjoy doing them by hand and seeing what's going on. Maybe one of these years we'll try TurboTax or something...

0 comments

The Republican's tax plan...whoa

Mood: astonished

Posted on 2011-04-05 21:04:00

Tags: taxes

Words: 108

I was listening on NPR about the plan and one detail made me do a double-take: they want to lower the top tax rate to 25%. (currently the rates are 10%, 15%, 25%, 28%, 33%, and 35%) Going from 35% to 25% sounded like a crazy reduction, especially for a plan that purports to balance the budget.

But, lo and behold, that number is correct. Currently, the 35% rate only goes into effect after the first $375K of taxable income.

Maaaaaybe, if you want to balance the budget but not privatize Medicare, you could not lower the top tax rate to the lowest it's been since the 1930's?

2 comments

I am the linkman

Mood: stressed

Posted on 2011-03-22 11:15:00

Tags: gay taxes links

Words: 161

- Firefox 4 is out today! Read about some of the changes (I've been using the beta for a while: it's significantly faster than 3.6) and download your copy today!

- Another poll shows more than half of Americans say gays and lesbians should be able to marry, which shows a "dramatic, long-term shift in public attitudes". In 2004 only 32% of Americans did, compared to 53% now. That is astounding!

- Another graph of tax rates over time - it uses relative colors rather than absolute, so it's less data-heavy than this old one, but it's certainly prettier! Yet another indication that taxes are quite low historically.

- Newly packed trains a mixed blessing for MetroRail - turns out they are meeting their projections, but they don't have money to buy more trains or expand the existing ones.

- After the Carmen Sandiego flashback, here's the story of Oregon Trail.

- Hurley from Lost visits a Lost-themed bar, appropriately named "Bharma". Jorge Garcia seems like a cool guy :-)

1 comment

naps!

Mood: cheerful

Posted on 2010-04-28 12:51:00

Tags: taxes links

Words: 122

The Comprehensive Guide to Better Naps - a lot of good advice, although I'm not much of a napper.

A neat visualization of tax rates over time - the change in the late 80s is very dramatic - before that there were around 20 different marginal tax rates, afterwards there were 4. Also kind of surprising that the first tax bracket was 0% for a while.

The Data-Driven Life - I'm heading that way, I think!

The Only Thing That Can Stop This Asteroid Is Your Liberal Arts Degree.

Now that Ze Frank's show is over, he does neat stuff like this chillout song. (although honestly the woman sounds seriously depressed and should probably see a doctor)

A giant flowchart to help you pick a font.

5 comments

Recent local laws...

Mood: hungry

Posted on 2007-02-12 11:51:00

Tags: dodgeball taxes snow poll

Words: 316

I heard about two proposed laws around here that I thought were interesting. One, in New York, would ban using electronic devices (such as iPods) while crossing the street (in response to the death of two such pedestrians) - the penalty would be a $100 fine. The other, in New Jersey (and proposed in Washington DC as well), would ban smoking in a car with children in it.

In my opinion, the New York law is way beyond the bounds of what the law should cover. It's common sense that you should pay attention while crossing the street - why not make it illegal not to look both ways?

The New Jersey one is a lot tougher...protecting children from secondhand smoke versus legislating what you can do in your car. I voted "No", but I could probably be convinced to vote "Yes". Maybe.

Anyway, I was just interested in what y'all thought.

Dodgeball was fun this weekend, except for getting the glasses knocked off of my face (they were OK, albeit a little more bent than before...I really need to get new frames at some point!) and running into a teammate which left my left cheek a bit tender. And this was in the match where the other team didn't have enough players! (so we lent them some of ours and played for fun)

There's supposed to be a big storm coming through tonight and tomorrow. Winter weather advisories and such. Hoping we get the day off!

Finally got around to doing my taxes this weekend - it was less painful than I thought and I ended up with a smallish refund. The state taxes thing was new, but you can do them online in a mostly painless manner. State taxes are high, though, especially considering that sales tax here is 5%, which doesn't seem like that much less than 8.25%. I guess property taxes are significantly lower, too?

11 comments

This backup was done by LJBackup.